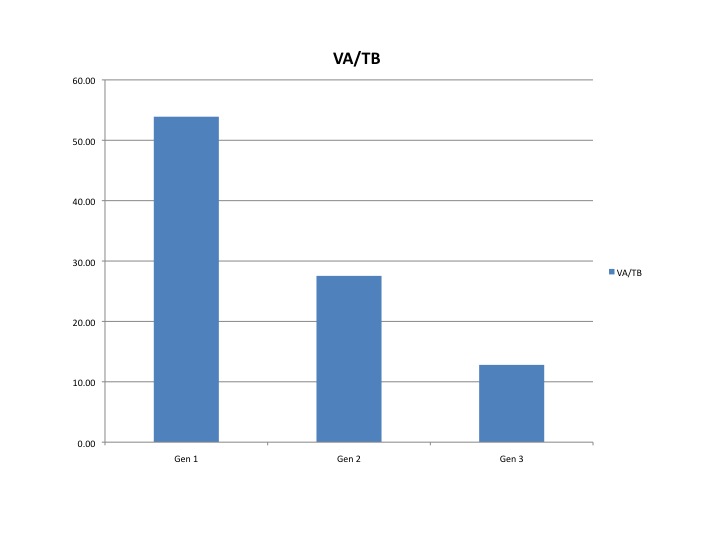

Recently I covered the ‘green shift’ of servers where each new server generation is not only driving major improvements in compute power but is also requires about the same or even less environmentals (power, cooling, space) as the previous generation. Thus, compute efficiency, or compute performance per watt, is improving exponentially. And this trend in servers, which started in 2005 or so, is also being repeated in storage. We have seen a similar improvement in power per terabyte for the past 3 generations (since 2007). Current storage product pipeline suggests this efficiency trend will continue for the next several years. Below is a chart showing representative improvements in storage efficiency (power per terabyte) across storage product generations from a leading vendor.

With current technology advances, a terabyte of storage on today’s devices requires approximately 1/5 of the amount of power as a device from 5 years ago. And these power requirements could drop even more precipitously with the advent of flash technology. By some estimates, there is a drop of 70% or more in power and space requirements with the switch to flash products. In addition to being far more power efficient, flash will offer huge performance advantages for applications with corresponding time reductions in completing workload. So expect flash storage to quickly convert the market once mainstream product introductions occur. IBM sees this as just around the corner, while other vendors see the flash conversion as 3 or more years out. In either scenario, there are continued major improvements in storage efficiency in the pipeline that deliver far lower power demands even with increasing storage requirements.

Ultimately, with the combined efficiency improvements of both storage and server environments over the next 3 to 5 years, most firms will see a net reduction in data center requirements. The typical corporate data center power requirements are approximately one half server, one third storage, and the rest being network and other devices. With the two biggest components experiencing ongoing dramatic power efficiency trends, the net power and space demand should decline in the coming years for all but the fastest growing firms. Add in the effects of virtualization, engineered stacks and SaaS and the data centers in place today should suffice for most firms if they maintain a healthy replacement pace of older technology and embrace virtualization.

Despite such improvements in efficiency, we still could see a major addition in total data center space because cloud and consumer firms like Facebook are investing major sums in new data centers. This resulting consumer data center boom also shows the effects of growing consumerization in the technology market place. Consumerization, which started with PCs and PC software, and then moved to smart phones, has impacted the underlying technologies dramatically. The most advanced compute chips are now those developed for smart phones and video games. Storage technology demand and advances are driven heavily by smart phones and products like the MacBook Air which already leverage only flash storage. The biggest and best data centers? No longer the domain of corporate demand, instead, consumer demand (e.g. Gmail, FaceBook, etc) drives bigger and more advanced centers. The proportion of data center space dedicated to direct consumer compute needs (a la GMail or Facebook) versus enterprise compute needs (even for companies that provide directly consumer services) will see a major shift from enterprise to consumer over the next decade. This will follow the shifts in chips and storage that at one time were driven by the enterprise space (and previously, the government) and are now driven by the consumer segment. And it is highly likely that there will be a surplus of enterprise class data centers (50K – 200K raised floor space) in the next 5 years. These centers are too small and inefficient for a consumer data center (500K – 2M or larger), and with declining demand and consolidation effects, plenty of enterprise data center space will be on the market.

As an IT leader, you should ensure your firm is riding the effects of the compute and storage efficiency trends. Further multiply these demand reduction effects by leveraging virtualization, engineered stacks and SaaS (where appropriate). If you have a healthy buffer of data center space now, you could avoid major investments and costs in data centers in the next 5 to 10 years by taking these measures. Those monies can instead be spent on functional investments that drive more direct business value or drop to the bottom line of your firm. If you have excess data centers, I recommend consolidating quickly and disposing of the space as soon as possible. These assets will be worth far less in the coming years with the likely oversupply. Perhaps you can partner with a cloud firm looking for data center space if your asset is strategic enough for them. Conversely, if you have minimal buffer and see continued higher business growth, it may be possible to acquire good data center assets for far less unit cost than in the past.

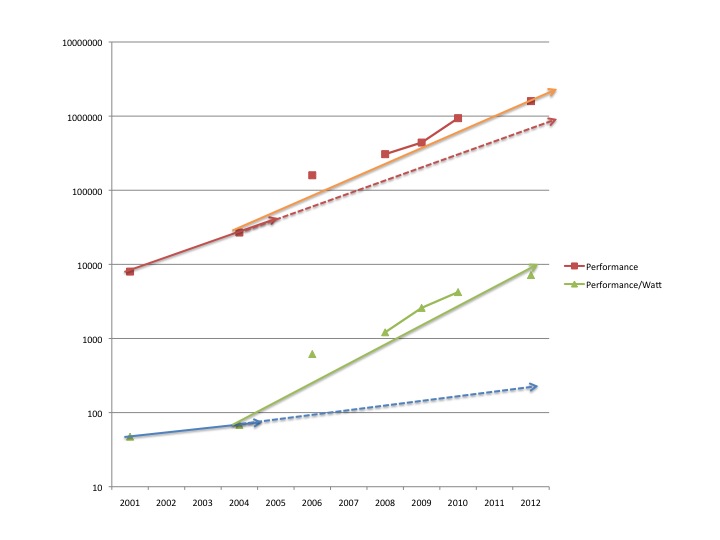

For 40 years, technology has ridden Moore’s Law to yield ever-more-powerful processors at lower cost. Its compounding effects have been astounding — and we are now seeing nearly 10 years of similar compounding on the power efficiency side of the equation (below is a chart for processor compute power advances and compute power efficiency advances).

The chart above shows how the compute efficiency (performance per watt — green line) has shifted dramatically from its historical trend (blue lines). And it’s improving about as fast as compute performance is improving (red lines), perhaps even faster.

These server and storage advances have resulted in fundamental changes in data centers and their demand trends for corporations. Top IT leaders will be take advantage of these trends and be able to direct more IT investment into business functionality and less into the supporting base utility costs of the data center, while still growing compute and storage capacities to meet business needs.

What trends are you seeing in your data center environment? Can you turn the corner on data center demand ? Are you able to meet your current and future business needs and growth within your current data center footprint and avoid adding data center capacity?

Best, Jim Ditmore

Greetings Jim,

Using external storage (electromagnetic spinning disks or solid-state drives) only to persist in-memory data for recovery purposes, to manage main memory overflow situations, to archive historical data and not for primary locus for data (as in traditional on-disk computing) can be the game changer in progressing a In-Memory Computing led Application Infrastructure landscape and ultimately a more green-data center.

The ever-growing need for processing large volumes of data (such as for on-demand-analytics or in event-processing scenarios), creating global-class Web

applications/mobile-enabled applications with high-scale/high-throughput/low-latency (such as financial trading, online gaming, software as a service (SaaS) and social networks) all necessitate ushering in IMC that will create a disruptive impact by radically changing users’ expectations, application design principles, products’ architecture and vendors’ strategy.

Ever declining DRAM and NAND flash memory costs, In-Memory DBMS/Data Grids, Global-class messaging infrastructure, In-Memory analytics tools, CEP platforms and In-Memory application servers can be the business cases to usher in IMC. As a starting point the IMC application infrastructure technologies can be complementary components of the traditional application platforms for projects with demanding requirements in performance, scalability and availability. With the CIO’s commitment to IMC, the medium to long term benefits include reduced infrastructure footprint/complexity, although IMC implies a higher investment in building new skills as well higher technology and vendor risks. The data computing paradigm will move away from being just forensic to predictive and ultimately predictive.

While IMC adoption accelerators include Performance/Scalability, Non-Stop operations, Real-time analytics, CEP & Situation awareness, the usual suspects for adoption inhibitors would be High software licenses costs, not-so-sure ROI’s, Scarcity of skills, Lack of standards/best-practices and a Skepticism about a new paradigm.

Best,

Sughosh

Hi Jim,

Great content as usual. Have you considered adding “Share” buttons to your blog so others can easily share your posts?

Rick,

Thanks for the suggestion – it is a good idea, I will check it out in WordPress to see if I can easily add this feature.

Best, Jim

Dear. Dr. Jim D

First of all, I appreciate for your informative article.

And I wonder few thing about your article

#1. The unit of Y axis : Ex) Hz/W ? IOPS/W ?

#2. What is the object of the performance?

or What processor do you measure or use to calculate?

ex) the fastest x86 processor, average of x 86 processors, the fastest processor at the year…

Please let me know two simple things,

Best Regard,

Jaeduck,

Good questions. The Y axis for the performance line (server performance) is SPECpower rating. Thus the Power per watt would be SPECpower per Watt. There is a good article at http://www.intel.com/assets/pdf/general/servertrendsreleasecomplete-v25.pdf that talks in detail about server power efficiency.

I actually plotted HP DL380s which gives a comparable product line across many years with a consistent architecture. The plot shows the introduction of each new model DL 380.

Best, Jim

And one more question!

What’s happened in 2006? What does makes the knee point, change the slope?

Jaeduck,

Again, good question. My view is what happened is power requirements became so significant that firms began including them as a criteria in selecting servers. As a result, it became important for manufacturers to not just turn out performance improvements but efficiency improvements as well. And there was a great deal of fertile ground for improvements and it became competitive advantange to have more energy efficient processors. What are your views on this?

Thanks, Jim